Research on Strategies for Banking

Research on Strategies for Developing Commercial Banks’ Personal Consumer Credit Business in the Context of Financial Technology

XIE XIE, CEO of Wuhan Kally New Energy Technologies

1 Introduction

1.1 Research Background

The development of personal consumer credit abroad is highly mature, yielding rich theoretical and practical achievements. The history of credit development in Western countries highlights the critical role of personal consumer credit in improving living standards and accelerating social and economic growth. In China, personal consumer credit emerged in the 1980s. Although theoretical research remains limited, as living standards rise, personal consumer credit has significantly transformed consumption patterns, expanding domestic demand to some extent. In an era of sustained economic growth, China has relaxed restrictive policies on personal consumer credit, introduced preferential measures, and prioritized its development to enhance commercial banks’ market competitiveness and drive national economic growth.

With the continuous advancement of internet and information technology, its importance across industries has become evident. The long-tail market of personal credit has given rise to financial technology (fintech), which, combined with the close connection between personal consumer credit and daily life, increases the complexity of credit management due to individual differences. In the fintech era, commercial banks must actively optimize their personal consumer credit services to provide more convenient and efficient solutions to customers.

This study examines the development of M Bank’s personal consumer credit business in the context of fintech, analyzing its current strategies, identifying existing issues, and proposing optimization strategies based on fintech realities to inject new momentum into M Bank’s personal consumer credit business.

1.2 Research Significance

1.2.1 Theoretical Significance

This study compiles and analyzes scholars’ research on personal consumer credit, integrating fintech and M Bank’s specific circumstances to further enrich theoretical research in this field.

1.2.2 Practical Significance

Focusing on M Bank, this study uses interviews to identify issues in its personal consumer credit business development and formulates optimization strategies. These findings provide new ideas for M Bank’s growth and offer reference value for other banks in the industry.

1.3 Research Status at Home and Abroad

1.3.1 Research Status Abroad

Foreign research on personal consumer credit began in the early 20th century, particularly after World War I, when governments emphasized stimulating consumer spending, significantly increasing actual consumption demand. Irving Fisher (1931) argued that human impatience drives a preference for immediate consumption over future-oriented planning, influencing wealth allocation across periods [1]. As fintech evolved, scholars like Straha and Mishkun (2019) noted that fintech enables near-symmetric information access for transaction parties, facilitating loan processes. They compared European and global peer banks, emphasizing that commercial banks must innovate to remain competitive, transforming into comprehensive financial service providers [2]. Saba Mushtaq (2016) suggested that banks should optimize operations using data analytics, especially in challenging economic environments [3]. A. Adem (2023) highlighted personal consumer credit as a vital banking component, advocating the integration of advanced IT and evaluation models to meet development needs [4].

1.3.2 Research Status in China

Compared to foreign research, China’s study of personal consumer credit is relatively recent but has made significant progress. Zhang Yue (2022) acknowledged the achievements of Chinese commercial banks in personal consumer credit, noting increased bank revenues and loan scales. However, issues like incomplete credit systems, low market regulation, and challenges in assessing collateral value pose risks. Through a case study of Shanghai Pudong Development Bank, Zhang proposed strategies like improving legal frameworks, enhancing data analytics, and refining credit systems [5]. Wang Lingxue (2022) identified a strong link between personal credit systems and internet-based consumer credit, emphasizing the need for robust credit systems to support its growth [6]. Bai Yun (2022) studied innovative consumer credit models for rural commercial banks, arguing that traditional methods cannot meet modern demands for fast, simple, and frequent credit. Leveraging internet and big data technologies can accelerate loan processing [7].

1.3.3 Research Review

From the literature, it is clear that scholars have primarily analyzed fintech’s macro-level impacts on risk management and credit business growth. This study builds on these frameworks, focusing on M Bank’s practical application of fintech in its personal consumer credit business, offering insights into its real-world impact.

2 Overview of Relevant Theories

2.1 The Concept of Financial Technology

2.1.1 Definition of Fintech

Fintech refers to technology-driven financial innovation, leveraging AI, cloud computing, big data, mobile devices, and the internet to transform and innovate traditional financial services, creating new products, services, or models. While fintech introduces innovation, its essence remains financial, retaining core functions and risk attributes.

2.1.2 Characteristics of Fintech

Fintech has several key features:

- Digitization: Data-driven processes enhance efficiency, accuracy, and accessibility.

- Intelligence: Machine learning and NLP improve risk assessment, regulatory oversight, and decision-making.

- Real-Time Capability: Enables dynamic monitoring of transactions, markets, and risks, enhancing responsiveness.

- Sharing: Facilitates data exchange among institutions and regulators, breaking information barriers and promoting market fairness.

2.1.3 Historical Development of Fintech

Fintech has evolved through several stages:

- 1950s–1970s: Computer technology enabled automated data processing for transactions.

- 1980s: Electronic trading systems reduced costs and increased transaction speeds.

- 1990s: Internet banking allowed users to conduct transactions online, reducing operational costs.

- 2000s–Present: Mobile internet, AI, and big data spurred innovations like mobile payments, online insurance, virtual currencies, and blockchain.

2.2 The Concept of Personal Consumer Credit Business

2.2.1 Definition

Personal consumer credit involves financial institutions providing funds to individuals for consumption and living needs, using credit, mortgages, pledges, or guarantees in monetary form. It includes personal loans, credit cards, installment plans, car loans, and home improvement loans.

2.2.2 Characteristics

- Individual Focus: Targets natural persons for personal consumption needs.

- Consumption Purpose: Used for non-profit activities like purchasing goods or services.

- Small Loan Amounts: Typically range from thousands to hundreds of thousands of yuan.

- Flexible Terms: Vary from months to decades, depending on repayment capacity.

- Diverse Guarantees: Include mortgages, pledges, and guarantees.

- Market-Based Rates: Interest rates align with market levels.

2.2.3 Main Models

- Small Bank Loans: Based on stable income, typically for salaried individuals.

- P2P Lending: Online platforms facilitate peer-to-peer loans (discontinued in China).

- Installment Payments: Banks pay merchants upfront, with consumers repaying in installments.

- Credit Cards: Allow consumption with flexible repayment options.

3 Current Development of H Bank’s Personal Consumer Credit Business

3.1 Overview of H Bank

H Bank, a secondary branch of a state-owned bank, was established in 1986 and has over 30 years of history with strong local influence. It offers services like international business, settlements, bills, loans, and deposits. By 2023, its deposit balance reached 31.5 billion yuan, loan balance 18 billion yuan, and net profit 453 million yuan, ranking high locally. With 36 branches and 810 employees, its network is urban-focused, lacking rural coverage.

H Bank has shifted its focus from corporate to retail banking, aiming to become a leading personal financial bank. It has invested heavily in personal consumer credit, achieving some progress but lagging behind industry peers.

3.2 H Bank’s Personal Consumer Credit Business

3.2.1 Main Products

- Personal Financial Asset Pledge Loan: Customers pledge assets like precious metals, funds, or bonds for loans up to the asset’s value, with a one-year term and lump-sum repayment.

- Personal Property Mortgage Loan: Uses property as collateral for loans up to 10 years, available for various legal consumption purposes.

- Personal Credit Loan (RongE Jie): A credit-based loan requiring no collateral, targeting high-quality clients with stable income or assets, managed online with pre-approved limits.

3.2.2 Development Scale

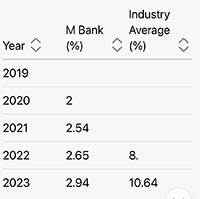

- Loan Balance Table 3-1: H Bank’s Personal Consumer Loan Development (2019–2023)

Source: Compiled from M Bank’s financial statements H Bank’s consumer loan balance grew from 2.72 billion to 3.61 billion yuan, with an average growth rate of 11.12%. However, compared to the industry’s 37.5% average growth rate (2019–2023), H Bank’s growth is modest.

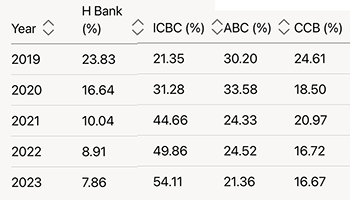

- Proportion of Consumer Loans Table 3-2: Proportion of Personal Consumer Loans at

Source: Compiled from M Bank’s financial statements H Bank’s consumer loans as a proportion of total personal loans declined until 2023, while the industry average doubled, highlighting H Bank’s lag.

- Market Share Table 3-3: H Bank’s Consumer Loan Market Share

Source: Compiled from banks’ financial statements H Bank’s market share has steadily declined, reflecting competitive pressures.

3.3 Integration of Fintech and H Bank’s Consumer Credit

In the thriving internet economy, H Bank recognizes fintech’s importance, setting a “fintech business” goal and establishing a fund (1% of the previous year’s pre-tax profit) for fintech innovation. It focuses on mobile-centric retail finance. However, fintech application is largely limited to optimizing operational systems, neglecting product marketing, innovation, resource sharing, and talent development, which restricts growth.

4 Issues in H Bank’s Personal Consumer Credit Business under Fintech

H Bank’s consumer credit business has grown slowly, lagging behind peers. Despite fintech advancements, H Bank relies heavily on traditional business models, limiting its development. Through data analysis and interviews with H Bank’s executives, managers, and loan officers, the following issues were identified:

4.1 Lack of Advanced Business Philosophy

4.1.1 Outdated Marketing Methods

H Bank relies on loan officers’ in-person promotion and walk-in clients, limiting customer reach and failing to leverage fintech’s marketing advantages. This approach restricts client growth to the officers’ personal capabilities, missing the internet’s potential for broad, low-cost marketing.

4.1.2 Lack of Product Innovation

As a traditional bank, H Bank promotes standardized products from its headquarters, neglecting consumption scenarios and limiting market share growth. Compared to competitors offering tailored products, H Bank lacks advantages in terms, rates, or loan conditions.

4.2 Incomplete Credit System

China’s credit system remains fragmented, with inadequate legal support, increasing risks and management costs for H Bank. Challenges include difficulty accessing non-local clients’ information, risks of fraud through third-party intermediaries, and limited access to social credit data beyond regulatory requirements.

4.3 Shortage of Fintech Talent

H Bank’s workforce is well-organized but lacks fintech expertise. Low salaries compared to industry peers and insufficient incentives contribute to talent loss, hindering innovation in the fast-evolving fintech landscape.

5 Strategies for Optimizing H Bank’s Personal Consumer Credit Business under Fintech

To address these issues, H Bank must adopt targeted strategies to enhance its consumer credit business.

5.1 Establish a Modern Business Philosophy

5.1.1 Integrate Online and Offline Strategies

H Bank should maintain its offline strengths, such as in-person services and physical branches, which some clients trust for reliability and post-loan support. Simultaneously, it should shift focus to online channels, using technologies like smart screens, QR codes, and Wi-Fi to build intelligent branches and experiential offline service hubs. This hybrid approach combines online convenience with offline trust, addressing post-loan service gaps in internet finance.

H Bank should also accelerate online loan services. Currently, over 90% of loans are processed offline, despite high procedural homogeneity. Promoting online applications, supported by offline client acquisition, can streamline processes and create a favorable environment for growth.

5.1.2 Implement Scenario-Based Marketing

H Bank should develop high-frequency consumption scenarios, integrating financing with consumer needs to create a “loan-payment” closed loop. This ensures compliant fund use and reduces fraud risks. Targeting sectors like education, home renovation, overseas study, and car purchases can enhance product appeal.

5.1.3 Enhance Product Innovation

To address homogenization, H Bank should design distinctive products based on consumption scenarios, tailoring offerings to client and merchant needs. Integrating technologies like electronic signatures and biometrics can improve convenience and security, expanding the customer base.

5.2 Leverage Big Data to Improve Credit Systems

H Bank should collaborate with government and tech entities to integrate data from social security, real estate, provident funds, taxes, and banks into a transparent credit system. This reduces information asymmetry and post-loan default risks.

5.3 Strengthen Fintech Talent Development

H Bank must prioritize building a skilled fintech workforce through training and recruitment. Regular training in internet finance, competitive salaries, and transparent promotion pathways can attract and retain talent, fostering enthusiasm for optimizing consumer credit operations.

6 Conclusion

This study analyzed H Bank’s personal consumer credit business under fintech, identifying its status, issues, and optimization strategies. Key findings include:

- Despite efforts, H Bank’s consumer credit business lags behind peers in development.

- Issues include outdated philosophies, incomplete credit systems, and talent shortages.

- Optimization requires modern business strategies, big data-driven credit systems, and robust talent development.

References

[1] Fisher, Irving. The Theory of Interest as Determined by Impatience to Spend Income and Opportunity to Invest It. New York: Martino Fine Books, 2012.

[2] Mishkin, F.S. & P. Strahan. What Will Technology Do to the Financial Structure? In Litan, R. and A. Santomero (eds.), The Effect of Technology on the Financial Sector. Brookings-Wharton Papers on Financial Services, 2019.

[3] Saba Mushtaq. Causality between bank’s major activities and economic growth: evidences from Pakistan. Financial Innovation, 2016, 2(1):123-143.

[4] Adem A, Suleyman B, Fangcheng R. Dynamic Equilibrium with Costly Short-Selling and Lending Market. The Review of Financial Studies, 2023, 17(2):2.

[5] Zhang Yue. Research on Risk Prevention of Personal Consumer Credit Business of Pudong Development Bank. Economics, 2022, 5(1):63-66.

[6] Wang Lingxue. On the Development Status and Issues of Personal Credit Systems under Internet Consumer Credit in China. Modern Business, 2022, 15(30):45-48.

[7] Bai Yun. Research on Innovation of Consumer Credit Models for Rural Commercial Banks under Internet Finance. China Collective Economy, 2022, 27(5):74-75.

[8] Li Haoqi, Lin Huazhen, Huang Fu. Study on Factors Affecting Risks of Personal Microcredit. Mathematical Statistics and Management, 2022, 41(6):11.

[9] Wu Yue, Zhang Yingjie, Lu Tian, et al. Consumption Behavior and Credit Default: An Empirical Analysis Based on Self-Regulation Theory. Journal of Economic Management, 2023, 2(2):97-128.

[10] Yu Yichen. Reflections on J Bank’s Credit Card Marketing. Leasing and Sales Intelligence, 2022, 32(1):44-46.

[11] Jin Xia. Risk Analysis and Preventive Measures for Bank Consumer Credit Loans in the Internet Context. Times Business, 2022, 45(6):19-21.

[12] Cui Xinxin. Difficulties and Solutions in the Digital Transformation of Bank Consumer Credit Business. Modern Business, 2022, 29(8):4.

[13] Ren Kai. Comparison and Development Strategies for Bank Consumer Credit and Internet Finance. Finance World, 2022, 52(33):3.

3199 Flowers Rd S,Atlanta USA

3199 Flowers Rd S,Atlanta USA +1 678 568 1288

+1 678 568 1288 wfoservice@hotmail.com

wfoservice@hotmail.com