Why is strong stimulus necessary during the real estate downturn cycle?

1、 The Ideal Equilibrium Growth Model

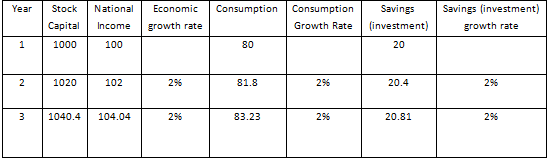

According to the Harold Thomas growth model, g=s/k, where g is the national income growth rate, that is, the economic growth rate; S is the savings rate, which is the proportion of savings to national income; K is the capital output ratio, which is the amount of capital required to produce one unit of output. If s and k remain constant, and all savings can be smoothly converted into investment, national income, consumption, savings, and investment will maintain the same fixed growth rate g, without fluctuations in economic cycles and growth rates. Here are some examples:

If the initial stock capital of a country is 1000, s is 20%, and k is 10, the annual situation is as follows:

By analogy, national income, consumption, savings, and investment will maintain a fixed growth rate of 2% each year, with a constant growth rate. This is the ideal state of constant equilibrium growth: investment is based on consumption, investment and consumption remain balanced, the accumulation rate (savings rate) is stable, savings are smoothly converted into investment, national income grows in equilibrium, without fluctuations in growth rates or economic cycles.

2、 Reasons for deviation from ideal state, fluctuations in economic growth rate, and formation of economic cycles

1. The cycle of dominant industries in industrial structure changes brings about changes in savings rates and capital output ratios, resulting in changes in consumption, investment, and economic growth rates. During periods of stable industrial structure, such as agricultural society, industrialization before the arrival of information technology, and the arrival of new technological revolutions after the completion of information technology, the equilibrium growth model is basically met. Due to the lack of new consumer products, only the updating and improvement of existing products, consumption, investment, and national income can only maintain low-speed growth, and the savings rate passively remains low. But during the period of industrial structural changes, especially from the beginning of industrialization to the completion of this industrialization and urbanization stage, the industrial structure undergoes drastic changes, and every technological change or introduction innovates a dominant consumer product and its supporting industrial chain. Historically, the leading industrial chains of industrialized countries have clearly gone from light industrialization of textiles, household appliances, automobiles and real estate to completion of heavy industrialization. The leading products of innovation in the informatization stage are computers, mobile phones and the Internet, and AI is currently being brewed. Each leading industrial chain has a period of introduction, growth and popularization, and a period of maturity and decline, which has led to great changes in the growth rate of consumption of new consumer goods in the leading industry and the growth rate of investment in the leading industrial chain. This change will also affect the growth rate of consumption and investment in the original industry through the industrial linkage between the leading industrial chain and the original industry. All these changes will lead to changes in the total social savings rate s; In addition, every time there is a technological change or introduction, the capital output ratio k changes, which in turn changes the economic growth rate g, forming an economic cycle that follows the dominant industrial chain cycle. Below, we will elaborate on the formation process of the economic cycle based on the introduction period, growth and popularization period, maturity period, and decline period of the dominant industry chain.

(1) The new consumer goods created by the application of new technologies during the import period have just been introduced to the market, with high costs and high prices but high marginal utility. They are mainly purchased by the wealthy, with low production and sales but fast growth rates. The product profits are high, and the investment growth rate of industrial chain enterprises is fast, which drives the growth rate of social consumption and investment, and also increases the social savings rate and investment rate. The surplus labor and capital in the original industries continue to transfer to new industries and improve labor productivity. Due to the overall increase in capital intensity after industrialization, although the output increases rapidly and the direction of the change in the capital output ratio k is uncertain, the economic growth rate g is increasing due to the rapid increase in the savings rate S. However, due to the relatively low output of the new product industry chain, which accounts for a small proportion of the total social output, the growth rate of g is not fast. The history of industrialization and informatization economies in various countries has also confirmed this, and this stage has achieved the recovery stage of the economic cycle.

(2) During the growth and popularization period, as technology, processes, and equipment continue to mature and improve, the cost of leading products in the industry chain continues to decrease, and products continue to be popularized to ordinary residents and even low-income residents. The sales volume and revenue of products grow rapidly, driving a rapid increase in consumption throughout society; The leading industry chain enterprises are continuously increasing their investment efforts to expand production capacity, driving a rapid increase in investment throughout society, and the social savings rate is also rapidly rising. The surplus labor and capital in existing industries continue to transfer to new industries and improve labor productivity. Due to rapid technological progress, the output of dominant industrial chain products is rapidly increasing and their proportion in the national economy is rapidly expanding, resulting in a decrease in the capital output ratio k. The combination of multiple factors has led to rapid growth in consumption, investment, and national income, resulting in a rapid increase in economic growth rate, a significant decrease in unemployment rate, high capacity utilization rate, and even inflationary pressure. This stage has achieved the peak of the economic cycle.

(3) During the mature decline period, when the dominant industry's new consumer goods have reached saturation among all residents, the demand for the new consumer goods decreases significantly. Only the demand for updates and slight improvements in products can be improved. Due to the decrease in demand for the dominant industry's new consumer goods, the overall consumption of society will decline; Due to the decrease in demand for products in the dominant industry chain and the formation of a large amount of production capacity through investment during the growth and popularization period, there is overcapacity in the industry chain, resulting in a decrease in investment in the industry chain and driving a decrease in investment in the whole society. The decline in income, overcapacity, and rising unemployment in the dominant industry chain have led to a decrease in demand for existing industries in the dominant industry chain. The growth of consumption, investment, and income in the entire society relies on the updating and growth of existing industries, resulting in a decline or even negative growth rate of consumption, investment, and income growth. This stage leads to the stagnation or even decline of the economic cycle, and the whole society is trapped in overcapacity, rising unemployment, and deflation.

The economic history of various countries has verified the hypothesis that the dominant industry cycle determines the economic cycle. The dominant industry in the United States in the 1920s was automobile manufacturing. In 1929, the automobile penetration rate in American households was 90%, which means that almost every household had a car. In addition, washing machines, phonographs, furniture, jewelry, and clothing also partially assumed the functions of the dominant industry. Under the current income level and distribution structure, the saturation of automobiles led to the Great Depression. After the Great Depression, especially after World War II, the home appliance industry such as washing machines, dishwashers, televisions, dryers, and air conditioners became the dominant industry. With the further popularization of automobiles, it brought prosperity to the United States in the 1950s and 1960s. Refrigerators were first popularized in the United States, with a penetration rate increasing from 10% in 1930 to 81% in 1950. Subsequently, washing machines, dishwashers, televisions, dryers, and air conditioners also began to accelerate their popularity in 1960-1970. Whether it is washing machines, televisions, and air conditioners that are essential household appliances, or dishwashers and dryers with relatively higher demand elasticity, they are all beginning to enter ordinary households. The number of cars per thousand people in the United States increased from 87 in 1920 to 500 in 1967. In the 1970s, due to the saturation of household appliances and the lack of new leading industries, coupled with the oil crisis, the United States entered stagflation. In the 1980s, the "baby boomer" generation born after World War II gradually entered society in the 1970s and 1980s, with an increasing rigid demand for real estate. The real estate industry became the dominant industry, driving a new round of upgrades in home appliances and automobiles. During the rapid development of the home appliance market in the 1980s, kitchen appliances represented by microwave ovens quickly became popular in this household appliance consumption upgrade. And the home furnishing industry has also experienced rapid development due to the influence of the real estate industry. The automotive industry is also experiencing a consumption upgrade, with consumers' demand for cars becoming more diversified. The proportion of households owning two or more cars is constantly increasing, and there is also an increase in female car owners, which further diversifies the consumer group and makes the market more segmented. In the 1990s, personal computers were rapidly popularized and gradually became the necessary consumer goods for people's life and work, which gave rise to huge market demand from computer hardware to software, and from stand-alone to network. The computer and Internet industry became the leading industry, creating a number of technology enterprises providing computer and network software and hardware facilities, such as Cisco, Dell, Microsoft and Intel. After the bursting of the Internet foam in 2000, benefiting from the in-depth development of information electronization, PC and mobile phones were combined as smart phones, and electronic components and communication equipment represented by Apple's industrial chain became a new leading industry; At the same time, biotechnology continues to break through bottlenecks, and the medical technology industry is also developing rapidly, jointly bringing about the economic prosperity of the United States in the 21st century. At present, there is a trend for the AI industry to become a new dominant industry. After World War II, Japan's leading industry also experienced a similar development path of semiconductor industries such as textiles - household appliances - automobiles - computers and integrated circuits - real estate. Since the 1990s, because of the failure to seize the opportunity of the Internet industry, no new leading industry has emerged and the collapse of the foam economy, it has been trapped in the "lost three decades". After China's reform and opening up, it experienced similar changes in the dominant industry chain: the textile industry chain was the dominant industry chain in the 1980s, and the home appliance industry chain was the dominant industry chain in the 1990s; From 2000 to 2021, real estate is the core leading industry chain, while mobile phones, computers, the Internet and automobiles are complementary leading industry chains. The successive development of these leading industries has brought about high-speed growth in China for more than 40 years, and at the end of each era, due to the saturation of the leading industry chain in the previous stage and the lack of connection between one leading industry chain, the economic growth rate has dropped significantly for 1-2 years, with a very obvious periodicity. After 2012, mobile phones, computers, Internet and cars are basically saturated, but real estate sales will not fall back until 2021. Therefore, after 2012, China's economy will enter a medium speed growth, and after 2022, it will enter a low speed growth. At present, it is in a low speed growth stage, waiting for the next leading industrial chain, such as AI application, to bring about economic growth recovery.

2. The excessive income distribution gap reduces total demand and exacerbates economic cycle fluctuations.

From the perspective of the short-term cycle of national income, the key to a smooth cycle of the national economy is the smooth conversion of savings into investment. Investment demand constitutes an important component of total demand and plays a significant role in economic fluctuations. However, in the long run, savings (investments) are all about delaying consumption, with the aim of having more consumption in the future. Therefore, investment demand must be based on the premise of more consumption demand in the future. In the short term, it is demand, and in the long run, it is supply. Enterprises must make investment decisions based on the premise that the project's future output has demand and can obtain reasonable investment returns. The new dominant industry must be one that creates new consumer goods through new technologies, satisfies the consumption of the wealthy during the introduction period, and satisfies the consumption of the masses during the growth and maturity period. The large income distribution gap is generally due to the excessive proportion of profits and low labor remuneration in the initial distribution of national income, resulting in a high proportion of income for wealthy individuals such as capitalists and entrepreneurs who obtain profits. Their income far exceeds the total consumption of themselves and their families, and even exceeds the consumption of multiple generations of the family. Therefore, the purpose of their savings (investment) is not to consume more in the future, but to obtain more wealth. The products produced by these savings (investments) must be sold for the future consumption of others (the masses), and the savings (investment) income belongs to the savings (investors). This creates a fundamental contradiction: the owner of investment income does not consume, which is contradictory to the essence of investment. The output of investment projects has no demand, and in severe cases, it can occur. Economic crisis exacerbates economic cycle fluctuations. Specifically, when it comes to the new dominant consumer products, the low income of the general public reduces the demand during the mature growth period, resulting in rapid saturation of demand for new products and a short economic prosperity cycle. One of the important reasons for the Great Depression in the 1930s in the United States was the large income distribution gap. By the end of the 1920s, the 16 largest financial conglomerates in the country controlled 53% of the country's gross domestic product, and one-third of the national income was held by the wealthiest 5% of the population; On the other hand, about 60% of American households still struggle with a living standard of around $2000 per year, which is barely enough to cover their basic needs. What's even more serious is that 21% of households have an annual income of less than $1000. The public's consumption of leading consumer goods is more supported by consumer credit. In the 1920s, consumer credit has also become a daily business for Americans. At that time, three quarters of cars were purchased by installment. When the future demand for overdraft reaches the credit repayment date, the demand contraction and economic depression will be exacerbated. The contraction of consumer demand automatically leads to a contraction of investment, and an economic depression occurs.

3、 How to deal with deviations: countercyclical regulation of economic cycles

Excessive economic cycle fluctuations are detrimental to the rational allocation and utilization of resources. During periods of economic prosperity, overinvestment leads to excess production capacity, while during periods of economic recession, negative feedback from consumer and investment demand leads to a spiral contraction of production capacity utilization, an increase in unemployment rate, resource waste, and serious impact on residents' income and welfare. In fact, this is a manifestation of market failure. It is necessary for the government to take countercyclical intervention measures to reduce economic fluctuations and social welfare losses.

To reduce economic fluctuations and smooth out economic cycles as much as possible, the first step is to carry out institutional reforms to regulate income distribution and reduce income inequality. After the Great Depression, especially after World War II, capitalist countries in Europe and America generally established minimum wages, encouraged the establishment of trade unions, and negotiated with employers to protect labor rights; Implementing progressive income tax and inheritance tax to regulate income distribution; Implementing a social welfare system to ensure the income and livelihood of low-income groups; The decentralization and socialization of equity in listed companies increase the property income of the general public. All these reforms and policies are conducive to reducing income inequality, stabilizing consumption and investment, and reducing economic fluctuations. Secondly, and more importantly, implementing countercyclical fiscal and monetary policies to regulate overall social demand. Specifically, during the growth and popularization period of the dominant industrial chain and the stage of economic prosperity, contractionary fiscal and monetary policies should be implemented, tax rates should be increased, and fiscal expenditures should be reduced to form fiscal surpluses in order to reduce total social demand; Raising interest rates, reducing the money supply, and increasing tax rates to reduce the willingness of enterprises to invest can reduce future overcapacity while reducing investment demand. In the mature and declining period of the dominant industry chain, also known as the economic recession period, due to the negative feedback of consumption and investment in the dominant industry chain, which leads to a decrease in consumption and investment in the original industries, the entire national economy experiences overcapacity, rising unemployment rate, falling prices, and a decrease in residents' income and welfare. At this time, it is particularly necessary to implement deficit fiscal policies, using government demand to compensate for the insufficient total demand to improve capacity utilization, reduce unemployment rate, and combat deflation, thereby increasing residents' income and welfare and creating a favorable economic environment for the cultivation of the dominant industry in the next stage. Government demand can be public investment demand, public consumption demand, or transfer payments to low-income groups to increase consumption demand. In terms of monetary policy, interest rates are lowered and money supply is relaxed. However, due to the poor confidence and expectations of businesses and residents in the future during this stage, the effectiveness of monetary policy is not good and often falls into liquidity traps. Therefore, deficit fiscal policy should be the main approach. After the Great Depression in the 1930s, capitalist countries such as Europe, America, and Japan generally implemented countercyclical fiscal and monetary policies. Typical examples include the Roosevelt New Deal in the United States in the 1930s, the response policies of various countries after the 2008 subprime mortgage crisis, and the epidemic response policies from 2000 to 2001; Japan fought against deflation after the bursting of its real estate foam in the 1990s. After China's reform and opening up, it also learned and introduced Western macroeconomic theories on the basis of the original national economic comprehensive balance theory to carry out countercyclical regulation of the macro economy. Typical examples include the anti inflation tightening policy in the late 1980s, the economic stimulus policy in the late 1990s, the 4 trillion yuan fiscal stimulus policy in 2008, and the current anti deflation series of policies. The countercyclical regulation policies of various countries have effectively reduced economic fluctuations, smoothed out economic cycles to a certain extent, reduced resource waste, and improved residents' income and social welfare, which is of great significance.

4、 The downward cycle of the leading real estate industry chain requires more countercyclical regulation

Real estate, due to its high unit price, large industry scale, long industrial chain, and long upward cycle, usually around 20 years, but the downward cycle can also last for about 20 years. Both upward and downward cycles have a huge impact on the national economy. In the real estate downturn cycle, in addition to the direct decline in income from the real estate industry chain leading to a decrease in national economic growth, the decline in purchasing power of residents in this industry chain seriously affects consumption in other industries and thus affects investment in other industries, exacerbating the decline in national economic growth. In addition, as an important asset for residents, the decline in real estate prices also affects residents' consumption through the wealth effect, leading to a decline in the balance sheet. Therefore, in the real estate downturn cycle, countercyclical regulation is even more necessary. Compared to other dominant industry chains, the duration of countercyclical regulation is longer and the intensity needs to be greater in order to hedge its impact on total demand and solve overcapacity and deflation. The anti deflation experience and lessons of the Japanese government after the real estate foam burst are typical of this point.

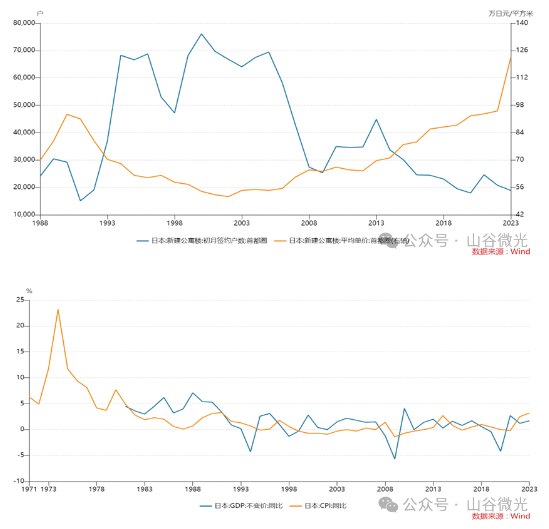

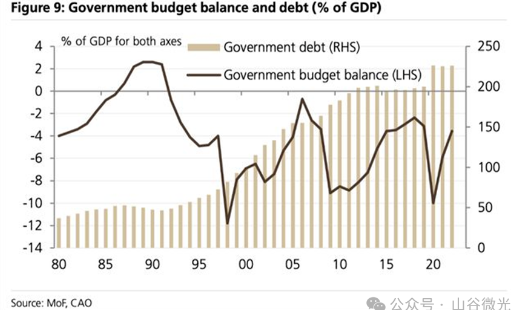

The Japanese government launched a number of fiscal packages after the bursting of the real estate foam in the late 1990s, mainly public investment and tax cuts to stimulate the economy. The ratio of government debt to GDP continues to rise.

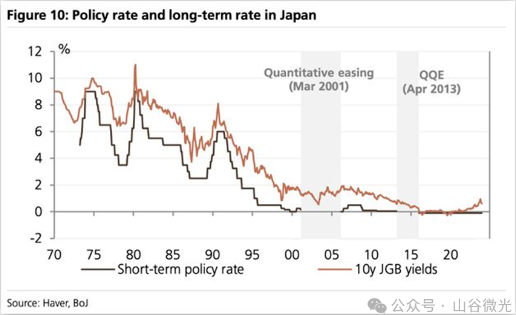

The Bank of Japan lowered interest rates to zero in 1999 and even introduced various unconventional policies, such as quantitative easing in 2001, negative interest rate policy in 2016, and yield curve control (YCC).

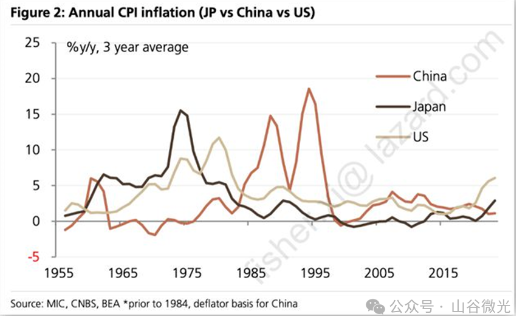

These policies helped Japan avoid the Great Depression. However, due to the lack of understanding of the economic situation, the policy was taken too late, stopped and stopped halfway, and the coordination of fiscal and monetary policies was insufficient. In addition, the Asian financial crisis, the US Internet foam burst, and the subprime mortgage crisis hit Japan during the period, the policy effect was not ideal, and it has not been out of deflation. In 2013, Japanese Prime Minister Shinzo Abe introduced a series of Abenomics policies centered around monetary easing, flexible fiscal policies, and structural reforms. The Japanese economy finally emerged from deflation after 2022, and the Bank of Japan finally saw the long-awaited shadow of "sustainable inflation". In 2022 and 2023, Japan's CPI will be 2.5% and 3.2% respectively, exceeding the Bank of Japan's inflation target of 2% for the first two consecutive years, with economic growth rates of 1.2% and 1.7%, respectively. Since 2024, the year-on-year CPI for each month has remained above 2%.

Since the housing system reform in 1998, real estate has become the leading industry in China's national economy since 2000. The sales area and amount of commercial housing have increased from 357.2 billion square meters and 1698.41 billion yuan in 2000 to 18192.995 billion square meters and 179433.41 billion yuan in 2021, driving the high-speed growth of the Chinese economy in 2021.

After 2022, due to the decline of the real estate industry chain and the scar effect of the epidemic, consumption and investment in other industries have also been severely affected, and the Chinese economy has entered a downturn cycle. The economic growth rates for 2022, 2023, and 2024 are 2.95%, 5.25%, and 5.0%, respectively. PPI has been negative since October 2022, and CPI has been below 1% since March 2023. The Chinese economy has entered a deflationary phase, with stagnant growth in household income, corporate profits, and fiscal revenue. Overcapacity, rising unemployment, negative population growth and aging, falling stock and housing prices, shrinking household wealth, significant decline in local government land sales revenue, increased debt burden, and increased debt risk. Similar to Japan at that time, effective measures need to be taken for strong countercyclical regulation to overcome deflation and economic difficulties. Firstly, it is necessary to have a clear understanding and firm policies: the deflation caused by the real estate downturn cycle is actually a waste of production capacity and an increase in unemployment rate due to a decrease in total demand, which is a loss of overall social welfare. We must resolutely use fiscal deficits to make up for the gap in private total demand, achieve full utilization of production capacity and full employment, and raise the economic growth rate to the potential growth rate level, thereby improving the overall social welfare level. In terms of anti deflation, we must be resolute and not hesitate to start and stop. Japan's judgment of the situation and implementation of fiscal deficit policies and loose monetary policies have seriously affected the cumulative effect of policies. The national economy has entered a long period of chronic deflation, losing thirty years of valuable economic development time. Secondly, the funds from issuing bonds for fiscal deficits should mainly be used for consumption. The second part of this article has already discussed that each round of dominant industries will form core dominant consumer goods. Ultimately, changes in demand for these core dominant consumer goods bring about changes in the economic cycle. Although real estate, especially residential properties, have both consumption and investment attributes, they are still consumer goods. The reduction in demand for real estate consumption leads to a decrease in income in the real estate industry chain, which in turn reduces demand for other consumer goods and leads to a decrease in investment demand. Therefore, the most fundamental and effective measure to hedge its impact is to use fiscal funds to form public consumption or distribute money to residents, especially the middle and low-income groups, to gradually transfer the production capacity and labor force of the real estate industry chain to other consumer goods industry chains. It is more reasonable to reallocate resources to consumer goods than to reallocate resources to infrastructure (in fact, as China's population declines and industrialization and urbanization are basically completed, China's infrastructure is basically saturated), which is also conducive to changing the pattern of low consumption proportion in China for a long time. In fact, an important reason for the unsatisfactory effect of Japan's anti deflation policy back then was that most of the fiscal funds were invested in infrastructure, especially in rural and remote areas, with little impact on private consumption and investment, low multiplier effect, and serious waste in reality.

(The above two figures are both quoted from Li Xunlei's "Shallow Risk and Bottom Risk", September 2024)

5、 Discussion on several related issues

1. The problem of government debt burden. The issue of government fiscal balance changes with the understanding of government functions: in the classical capitalist era, the government was defined as a night watchman, only a limited government that maintained social order. Therefore, it was required to minimize expenditures and maintain fiscal balance, and fiscal deficits were not allowed; After the Great Depression of 1929-1933, developed capitalist countries entrusted their governments with macroeconomic regulation responsibilities, implementing deficit fiscal policies during economic downturns when total demand was insufficient, using public investment and consumption to compensate for the lack of private demand, and achieving full employment. So in the economic recession stage, the government is allowed to have a fiscal deficit, but theoretically, it is required to achieve a fiscal surplus during the economic prosperity stage, thereby achieving "fiscal balance of payments throughout the entire economic cycle". However, this cannot be achieved in the macroeconomic regulation practices of developed capitalist countries, especially with the widespread implementation of welfare states, where government spending is prone to increase but difficult to reduce. Based on this practical experience, the "fiscal constraint" represented by the Maastricht Treaty standard of the European Union has emerged: it stipulates that the government's annual budget deficit shall not exceed 3% of GDP, and the total debt shall not exceed 60% of GDP. But even this constraint has been broken through in practice: according to statistics from the International Monetary Fund, the average government debt ratio of G20 countries by the end of 2023 is 118.2%, including 249.7% for Japan, 134.6% for Italy, 118.7% for the United States, 109.9% for France, 107.5% for Canada, 100% for the United Kingdom, 84.7% for Brazil, 83% for India, and 62.7% for Germany; The average government debt ratio of G7 countries is 123.4%. But none of these countries have experienced debt crises or severe inflation. In fact, as analyzed in Part 2 of the previous text, due to the large income distribution gap in market economy countries, there will inevitably be some super rich people whose savings (investments, the same below) are "permanent savings saved for savings". This part of savings is not aimed at consumption within the life cycle or even across generations. The purpose of savings is to preserve and increase wealth. From the perspective of economic principles, the purpose of any savings must be future consumption, and future consumption must also be used as a means of value realization. Otherwise, it is unsustainable and will inevitably encounter a "bottleneck" at some point, leading to the inability of the national income cycle to flow smoothly and an economic crisis. Therefore, this part of "permanent savings" actually requires the government as a "permanent borrower" to issue "permanent bonds" to borrow for consumption or investment in order to achieve a smooth cycle of the national economy. The scale of this part of savings will become the source of funds for treasury bond as the economic growth continues to increase. The specific amount and the proportion of GDP are different in different countries, but there is a criterion for whether the government is over borrowing: whether there is serious inflation, only when the government borrowing significantly exceeds the private surplus savings will the total social demand far exceed the total social supply, and then there will be serious inflation. So Modern Monetary Theory (MMT) is correct: countries with sovereign currency issuance rights can finance expenditures by printing money without worrying about traditional debt defaults. MMT emphasizes the importance of employment security and social welfare, and believes that inflation is the real constraint. By the end of 2023, China's total government debt of full caliber will be about 130 trillion yuan, including 30 trillion yuan of treasury bond, 40.7 trillion yuan of local government statutory debt, and 60 trillion yuan of implicit debt. The government debt ratio will be about 100%. Compared with other countries, especially Japan, there is still more debt space. China's PPI has been in negative growth since October 2022, and CPI has been below 1% since March 2023. The Chinese economy has entered a deflationary stage, with overcapacity and severe internal competition in various industries. Price wars have become the main means of competition, and export products have led to anti-dumping and other trade wars. The fundamental reason is that the lack of overall demand at the macro level is ultimately due to insufficient consumption. Therefore, from the perspective of inflation as the ultimate constraint, there is greater room for government debt in China, and there is no need to worry about fiscal sustainability until inflation of over 3% occurs. Under the conditions of a market economy, the macro economy tends to be cold but difficult to warm up. After experiencing inflation of 3% or even 5% or more, implementing a tight monetary policy can easily reduce inflation. This has also been verified by the practice of macroeconomic regulation policies in developed countries and China.

2. The relationship between anti deflation and the development of new quality productive forces: Anti deflation is to improve the utilization rate of production capacity and reduce the idle rate of resources, including the unemployment rate, under the existing conditions of production capacity and industrial structure. It is of great significance to increase residents' income and social welfare. If the Roosevelt New Deal had not been implemented during the Great Depression in the United States, the economic downturn would have lasted for more years, with a greater magnitude of decline, higher unemployment rates for a longer period of time, and would have caused immense suffering to the people, even potentially leading to social unrest and the demise of the capitalist system; If Japan had not implemented a sustained anti deflation policy after 1990, it would have likely experienced negative growth instead of an average of 1% in the "lost thirty years", with higher unemployment rates, decreased household incomes, and more painful living conditions. It is likely that Japan has not yet emerged from deflation, and the stock and property markets will not be able to recover to their previous highs. So anti deflation is the top priority during the downturn phase of the economic cycle. The national economy has emerged from deflation, and residents' income, corporate profits, and fiscal revenue have steadily increased. Confidence and risk appetite of all parties will also improve, and the increase in income from all parties will have the ability to invest in new quality productivity. Therefore, anti deflation is conducive to the development of new quality productivity. Developing new quality productive forces is actually cultivating new leading industries. After successful cultivation, it can indeed bring about a new round of economic cycles, first of all, an economic upswing cycle, and also help to overcome deflation. Cultivating new leading industries is actually achieved by finding new directions for resource allocation to increase total demand and transfer existing excess capacity, but this process is relatively long and has great uncertainty. Although it may increase investment demand in the early stages of investment, thereby increasing overall social demand and helping to overcome deflation, investment failure can result in ineffective assets and a waste of resources. In fact, the key to successfully cultivating new leading industries lies in two aspects: first, having new technologies or even technological revolutions; The second is to innovate new leading consumer goods with new technologies, and form a new industrial chain with these new consumer goods. Without new consumer goods and hot topics, it is impossible to form a new dominant industry. Therefore, using anti deflationary fiscal funds for consumption is beneficial for consumers to choose new technologies and form effective new dominant industries. In fact, practice in various countries has proven that the service industry will develop rapidly after industrialization and urbanization, and can be said to be one of the inevitable leading industries. The use of anti deflation fiscal funds for consumption is also conducive to the development of the service industry. The development of the service industry has a significant promoting effect on improving employment rates, increasing residents' income, and boosting consumption, and has a great impact on accelerating the recovery from deflation. In summary, anti deflation and the development of new quality productive forces are mutually reinforcing, but in the stage of economic recession, anti deflation must be the first priority, and more fiscal funds should be used to increase consumption.

3. The relationship between anti deflation and reform: Some pure market forces deny the necessity and significance of macroeconomic regulation, believing that the market should be cleared automatically and deflation can be overcome through reform. This viewpoint is contrary to the economic history and reality of developed countries. Without Roosevelt's New Deal, the macroeconomic regulation and capitalist system of developed countries cannot be sustained. This group of scholars generally criticized China's macroeconomic regulation in response to the 2008 US subprime mortgage crisis. Due to space constraints, this article is difficult to discuss this topic, but only proposes a hypothesis: if China did not carry out macroeconomic regulation at that time when foreign trade was basically stopped, to what extent and for how long would China and the world experience an economic recession? Can new leading industries be cultivated without that macroeconomic regulation? As mentioned earlier, the current level of government debt in China is still relatively low. Although the burden of local government debt is heavy and needs to be addressed, China's infrastructure has also been further improved on the asset side. Although some infrastructure has low utilization rates, overall it has promoted China's industrialization and urbanization, thereby promoting economic development? I believe that anti deflation and reform are two different issues, one belongs to macroeconomic regulation and the other belongs to institutional improvement. Reform cannot replace anti deflation, nor can it replace it. If there is any direct relationship between the two, I think it is that reform should include income distribution reform, increasing the proportion of labor remuneration and thus increasing the proportion of consumption, which is conducive to anti deflation. A pure market economy without macroeconomic regulation in modern market economy is unrealistic and cannot operate sustainably.

(Author: Deng Liangyi, PhD in Economics from Wuhan University, currently working at Zhongliang Investment Property Management Co., Ltd.)

3199 Flowers Rd S,Atlanta USA

3199 Flowers Rd S,Atlanta USA +1 678 568 1288

+1 678 568 1288 wfoservice@hotmail.com

wfoservice@hotmail.com